How to lower your tax rate by moving your business to Russia

Although Russia does have a very low flat income tax rate compared to many other countries, especially in Western Europe, companies in Russia do get hit with high rates when making social contributions for their employees as a whole. However, there is one area in which Russian companies can save big amounts of money when hiring and that is if they take advantage of hiring foreigners with highly-qualified specialist status, or HQS. If you couple the low income tax rate of 13% with social contributions at 0% for hiring foreigners on HQS visas, that’s a recipe for major savings. Let’s see how we can apply this and whether it can realistically be implemented.

The HQS visa is a specific type of work visa that allows Russian companies to fairly quickly hire high-level experts across almost any field to come work for them. The processing of the work permit and HQS visa invitation is even reduced because of the stipulation they impose, which happens to be the only one major requirement. An HQS employee must have a salary of 2 million rubles per year, or about 167,000 rubles per month in order to be eligible for HQS status. With a dramatically weakened ruble, this brings the minimum yearly salary to around $30k. That is to say, an employee must earn at least $30k per year in order to qualify for an HQS visa.

What is so great about the HQS work visa and how does it compare to a typical work visa? Well, for starters, the HQS employee pays 13% income tax from day one for the whole period of the HQS visa and work permit no matter how much time the employee spends in Russia. A regular work visa sets the income tax rate at 30% until the foreigner becomes a tax resident after 183 days and then it drops to 13% like all tax residents. You can claim the difference back, however, you’ll have to be careful about how much time you spend outside of Russia so you don’t lose tax resident status. The HQS visa ignores all that.

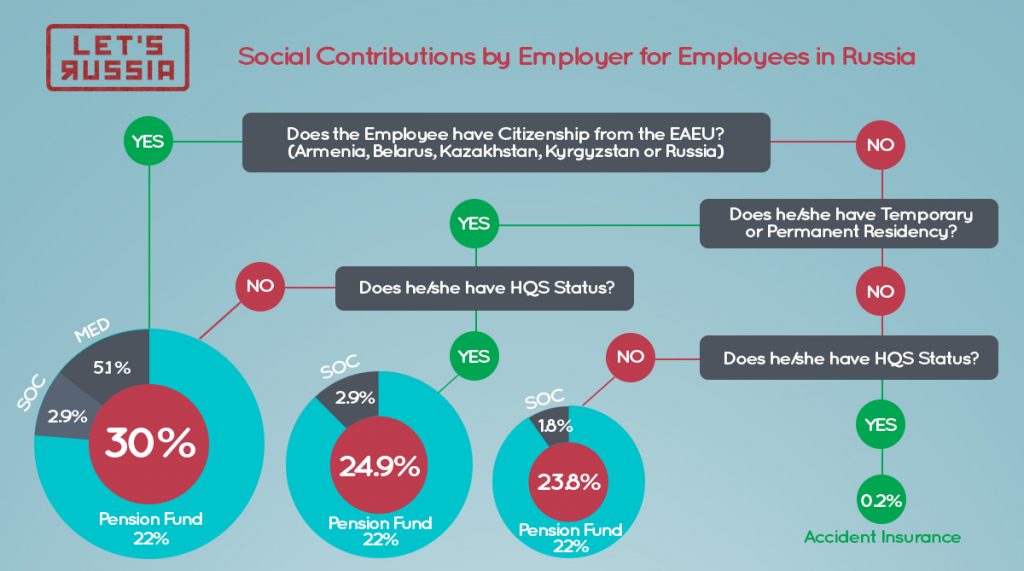

The other big deal about an HQS visa is that it imposes practically 0% social contributions on the employer to pay the State on behalf of the employee. A regular work visa would tack on at least 23.8% of the amount of a foreigner’s salary in social contributions for the employer to pay. The amount could reach up to 30% if the worker gains residency or citizenship. Granted, this is only the rate of contributions up to a maximum salary level after which the overall rate would decrease, but with a higher salary, there’s no reason to not hire a foreigner on the HQS visa. Click here to see some concrete numbers.

It sounds quite counterintuitive to make such exceptions but the idea is to attract talent to Russia and get a healthy influx of tax revenue from a high salary. The factor that was likely never considered was that the Russian ruble would drop so much rendering the actual minimum salary of a highly-qualified specialist an amusing $25,641 at its lowest point so far. Employers in other countries who have multiple employees will be the first to tell you how low-level employees cost a significant amount to employ when it comes to health insurance and minimum social contributions. In other words, low level full-time employees with benefits in western countries are expensive to hire and employ.

The combination of the above factors give foreigners an incentive to move an existing business or side business to Russia, if it can be either partially or fully run remotely. Whether you’re looking to move an existing business to Russia or start a new business in Russia, hiring yourself and other team members who are non-Russian citizens or residency holders can hold huge savings both in income tax and employer contributions. You could consider just moving a single employee or department to Russia to save big. So break out the calculator and see how much your business could be saving by incorporating a business in Russia and hiring foreigners. Use the tool we’ve created to calculate contributions your new Russian company would need to make depending on citizenship and status.

Please contact us if you’re ready to make the leap and incorporate a business in Russia. We’d love to help you take advantage of this option and help build your business while helping growing it in Russia. Click here to get your Russian company incorporated.